With so many people using cloud accounting software such as Xero, MYOB and QuickBooks it also opens up the area of addons or plugins that can be integrated with these cloud software. Using apps to save time with your bookkeeping just makes sense these days as we all find ways to get more time back.

Enter Receipt Bank

We recently trialled Receipt Bank within our own businesses and took a bit of time to understand how it works, and how it would best suit our clients. As we’ve been using it, the product has continued to be enhanced over time.

What is Receipt Bank?

In a nutshell, you take a photo of a receipt, it pulls the information out of that receipt and puts it into the receipt bank dashboard, where you can push it over to your accounting software without having to enter in details. It can even get details from hand written receipts!

What to expect with Receipt Bank

Although this is a very easy app to use, it does still have a learning curve that takes a bit of time. Overall however, you can expect to save time each and every week on entering details of receipts, when you allow Receipt Bank to do so automatically. You also need to adjust your habits. If you buy something and get a receipt, pull out your phone, take a photo and enter it in. After a while you can even throw those receipts away straight away as you also have a stored record of that receipt in your accounting software and in Receipt Bank, which is very handy in the case of an audit, warranty claim and more.

A Quick Guide to inputting receipts with Receipt Bank

Step 1 – Download the app

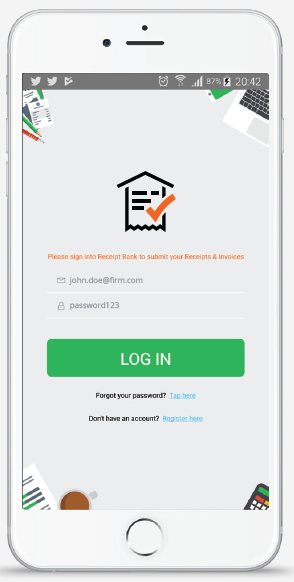

First step is to download the app on your phone. It is available on both IOS and Android, however there are a few minor differences between both of the operating systems.

Once you have the app downloaded you will need an account. You can either sign up for your own account or you can sign up through an accountant such as us. The benefit of signing up through an accountant is that you might be able to get on a plan that is not available to the general public. These can have some valuable time saving features. More about that later in the article.

Step 2 – Enter in your details

Enter in the account details into your app in the settings, and then you are able to take photos of your receipts in an instant.

Step 3 – Start taking photos

Just put the receipt down on a flat surface, point your phones camera at the receipt and take a photo. Press submit and that part is done. It really is that easy! There are a few different modes available which also help. More on that later in the article.

Step 4 – Integrate with your accounting software

Login to the online Receipt Bank admin at https://app.receipt-bank.com/login and then click account settings in the top right. Click on Integration then select the integration you would like to use. There are a few settings here that you can adjust too.

Step 5 – Check the submissions in the inbox

Once you have taken some photos and made the integration active to your accounting software such as Xero, then you can check that they are filled out correctly. If you are happy with the results you can then select the account that you would like to send it to Xero in, and then click publish. The main thing to make sure of is that the GST settings are coming through ok from my experience.

Step 6 – Go into Xero and reconcile.

The newly added receipt will automatically match, and you will get a green ok button for the receipt in the statement line in Xero.

Step 7 – Explore the other features

There are also a lot of other features that you can then begin to implement such as Invoice Fetch which allows you to login to a supplier and grab the invoices and bring them into Receipt Bank. Another way to get invoices into the system is to email them in via a dedicated email address that you are allocated. This means that those suppliers that send you an invoice to your email address can be sent straight in for processing. It will also find the values in the receipt and extract them into Receipt Bank. Once you have done this, you can then set up email rules to forward these on every time a receipt comes in via email.

What else we love about Receipt Bank

Since we have recently increased our subscription to the Streamline plan, we have been very excited about the additional features that we have at our finger tips. You can truly automate things, and push them through automatically. The ability to split receipts with supplier rules is fantastic for those that have a portion of personal expenses with some items such as electricity, fuel, car expenses and more. Bank match is another one that we can see is going to save us more time as we explore this feature more. You can also auto publish which means that if you are happy with how a certain receipt is looking each time then you can simply get it to automatically be added to Xero, without touching a thing.

Benefits of Using Receipt Bank

- Ability to extract information from a photo and automating data entry.

- Storage of your receipts in the cloud

- Huge Time Savings

- Less chance for error with automation reducing errors that occur with typing.

Receipt Bank Community

The company also has a place where you can learn more about Receipt Bank called Orange. It has been very handy to get more information about Receipt Bank, and best practices around using it within an accounting or bookkeeping firm.

Receipt Bank Support

One of the other parts that we love about Receipt Bank is the way that they support their product. From having the regular support channels to having an account manager that assists with many things it is very valuable to know that if you have issues that you have a point of contact. Each month we are invited to a local lunch which is held by Receipt Bank to see how local accountants and bookkeepers are going with Receipt Bank. It has been a great opportunity to go to these and chat to like minded people as a form of networking.

What can you do if you want to try it out?

The easiest way to go is to contact us and we will get you set up on an optimise plan. This gives you unlimited submissions and bonus features compared to the standard plans that are publicly available. Or if you don’t want those features, for around the same cost you can sign up directly with Receipt Bank