The ATO has revealed that it has requested to receive a further five years of policy information from over 30 insurance companies about taxpayers that are owners of :

- marine vessels

- thoroughbred horses

- fine art

- high valued motor vehicles

- aircrafts

We have seen many reports today about the expansion of records that the ATO has requested such as the article on Accountants Daily.

This is all part of the Australian Tax Office’s lifestyle assets data matching protocol. We have known for quite some time that the ATO is getting serious about using data matching to try to find abnormalities in tax payer information including those people that are living outside of their means.

The tax office uses this information to find when a taxpayer is increasing their assets at a higher rate than their income would suggest is possible. This is all a part of the wider net that the Australian Tax Office (ATO) is creating to catch fraudulent tax payers in the act, by using data that they have at their disposal, using their data matching protocols.

Other data matching protocols that they have in place include

- Contractor Payments

- Credit and Debit Cards

- Cryptocurrency

- Motor Vehicle Registries

- Rideshare data matching such as Uber, Ola etc.

- Short term accommodation such as Airbnb, Stayz etc.

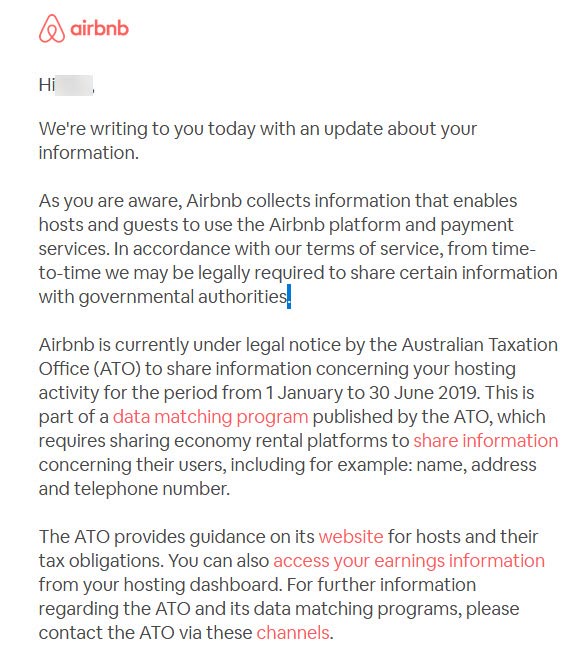

In October airbnb sent out emails to all property owners which looked similar to the one shown here.

Uber also sent out a similar email to their drivers and reported this in their app also. The gig economy has been highly targeted with data matching from the ATO.

We are sure that the data matching scheme has only just begun really as the ATO gets more power to gain insights into more data sources around the nation.

If you have any concerns or would like to discuss your tax options you can contact Ace Business.